Examine This Report about Financial Advisor Brisbane

Table of Contents10 Easy Facts About Financial Advisor Brisbane ExplainedThe Ultimate Guide To Financial Advisor BrisbaneExcitement About Financial Advisor Brisbane6 Easy Facts About Financial Advisor Brisbane ShownLittle Known Questions About Financial Advisor Brisbane.The smart Trick of Financial Advisor Brisbane That Nobody is DiscussingThe smart Trick of Financial Advisor Brisbane That Nobody is Talking About

Do they require to email a resume to a particular person? Monster work ads will certainly assist you find the ideal fit quick - Financial Advisor Brisbane.The ideal candidate will certainly be driven by an entrepreneurial spirit and the need to have a service. You should additionally be delighted by uncapped making possible and the ability to function on your own terms. Our experts are passionate concerning fixing problems for their clients while continuously looking into the finest techniques that lead to lasting results and relationships.

The basic objective is to help clients make notified choices concerning their money. To be a successful financial advisor, you generally need the following skills: Strong interaction skills Analytical abilities Organizational skills Analytic skills Sales abilities Technical abilities Ethics. Along with these soft skills, they likewise require to have a strong educational background in money, economics, or a relevant area, and acquire accreditations and licenses.

The smart Trick of Financial Advisor Brisbane That Nobody is Discussing

Financial experts can aid clients make educated choices regarding their financial resources, established and attain economic goals, and navigate complex financial markets. Additionally, economic consultants can provide a feeling of reassurance and self-confidence to customers, recognizing that they have actually a relied on expert on their side who is functioning to secure their economic passions.

The Best Strategy To Use For Financial Advisor Brisbane

When a customer pertains to see a financial expert, the consultant's very first step is generally to understand the customer's monetary goals, threat resistance, and financial investment preferences. This process is called the "discovery stage" and it is vital for the consultant to understand the client's financial circumstance and goals before supplying any kind of recommendations.

They usually gain compensations based on the purchases they perform for their customers. Robo-Advisor: A robo-advisor is a digital platform that utilizes algorithms to provide investment guidance and portfolio management services. They normally bill navigate here reduced charges than human consultants and are a prominent selection for younger capitalists that fit with utilizing innovation to handle their finances.

7 Simple Techniques For Financial Advisor Brisbane

They have a tendency to be enterprising people, which indicates they're daring, ambitious, assertive, extroverted, energetic, enthusiastic, certain, and hopeful. They are leading, persuasive, and motivational. Some of them are also standard, implying they're conscientious and conservative.

They might operate in a workplace setting or satisfy with clients in their homes or other places. Numerous monetary experts additionally work remotely or provide digital consultations to customers. Despite their office Our site setting, monetary experts generally spend a significant quantity of time meeting with customers and developing connections with them.

The Ultimate Guide To Financial Advisor Brisbane

This stress can be demanding and need consultants to function long hours - Financial Advisor Brisbane. Regulatory Conformity: Financial advisors have to adhere to a series of guidelines, such as those established by the Stocks and Exchange Commission (SEC) and the Financial Sector Regulatory Authority (FINRA). This can be taxing and calls for continuous interest to information

Some companies offer benefits at the end of the year as opposed to commissions. A lot of companies pay workers based upon their experience and qualifications. Entry-level financial organizers gain less than skilled ones. Your qualifications additionally influence your salary prospects. Accredited economic organizers command greater wages than those without accreditations.

The Only Guide for Financial Advisor Brisbane

People who work as monetary experts tend to have extremely gratifying and interesting professions. Financial advisors commonly get the satisfaction of assisting individuals accomplish their economic goals, while constantly learning and building on their own understanding and abilities. A profession in money can also give you a considerable, and safe and secure, gaining possibility.

A monetary planner is a specialist in aiding their customer to create methods to reach financial objectives. Whereas a monetary advisor is a more comprehensive term that can be used to brokers, bankers, and insurance policy business.

A Biased View of Financial Advisor Brisbane

This degree will certainly include a variety of topics like economic preparation, financing, and bookkeeping. New financial consultants need to complete and pass the ASIC financial expert examination to adhere to expert requirements. This will certainly examine your useful understanding in a variety of locations, like principles and interaction. The examination lasts for 3.5 hours.

There are great deals of excellent degrees that allow you to become a monetary advisor. Normally, a level will certainly take three to 4 years to complete.

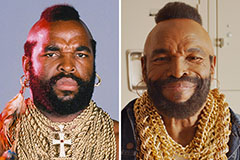

Mr. T Then & Now!

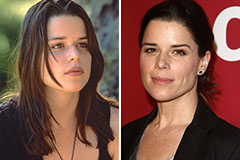

Mr. T Then & Now! Neve Campbell Then & Now!

Neve Campbell Then & Now! Kirk Cameron Then & Now!

Kirk Cameron Then & Now! Bo Derek Then & Now!

Bo Derek Then & Now! Catherine Bach Then & Now!

Catherine Bach Then & Now!